Unbeknownst to a number of Americans, your FICO score can do a lot in helping companies make decisions on who they will lend do.

In this article, you will learn not only what a FICO score is, but also seven tips that will help you fix and raise your FICO score.

WHAT IS A FICO SCORE?

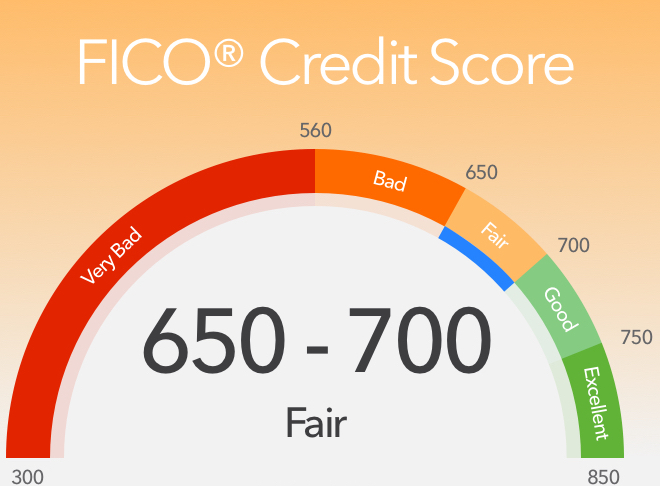

FICO stands for Fair Isaac Corporation. Lenders use your FICO score to help them determine if they can give you a line of credit that can help you purchase their products of services. For example, your FICO score is taken into mind when you apply for a loan, search for car financing, and so on.

There are many parts of your FICO score, but the main ones include your payment history, number of open accounts, and the age of your credit history. These all can be used alongside your earnings to determine if you are credible enough to be given financing opportunities.

Here are a few ways you can fix and raise your FICO score:

TIP 1: INCREASE YOUR PAYMENT AMOUNTS

If you have any open accounts where you owe money, you can quickly raise your FICO score by increasing the amount you are paying off each month. This will help you lower the amount you owe and ultimately raise your score.

TIP 2: CATCH UP ON PAYMENTS

If you went through a rough time and weren’t able to make your payments, you’ve likely incurred late payments and fees. To boost your FICO score, pay off these late fees and catch up on your payments now. This will increase your score almost immediately.

TIP 3: SEE ABOUT ADDING RENT TO YOUR CREDIT FILES

If you’ve never missed a rent payment, it could help to add your rent payment history to your credit score. It can help you and has been known to increase your credit score by at least 10 to 20 points.

TIP 4: BE RESPONSIBLE WITH CREDIT CARDS

Are you guilty of going on a shopping spree with help from your credit card? This can lead to you reaching your credit limit and having a tough time paying it off. Resolve to use your credit card for only a few things that you know you can pay off easily.

TIP 5: DISPUTE INACCURACIES

Do you see something on your credit report that doesn’t match your records? Dispute it with the company. Things happen and information can end up being neglected and not updated. This can help improve your score almost immediately.

TIP 6: LIMIT YOUR CREDIT USAGE

Not only does this mean limiting your credit card usage, but don’t apply for things that need a hard credit inquiry check as this can negatively impact your score. This could include car loans, house loans, and apartment qualifications.

TIP 7: CONTACT A LENDER IF YOU’RE HAVING TROUBLE

Things happen in life that make it hard to pay back your debts. Call up your lending company and ask about programs that can help you pay your debts off easily.

0 Comments